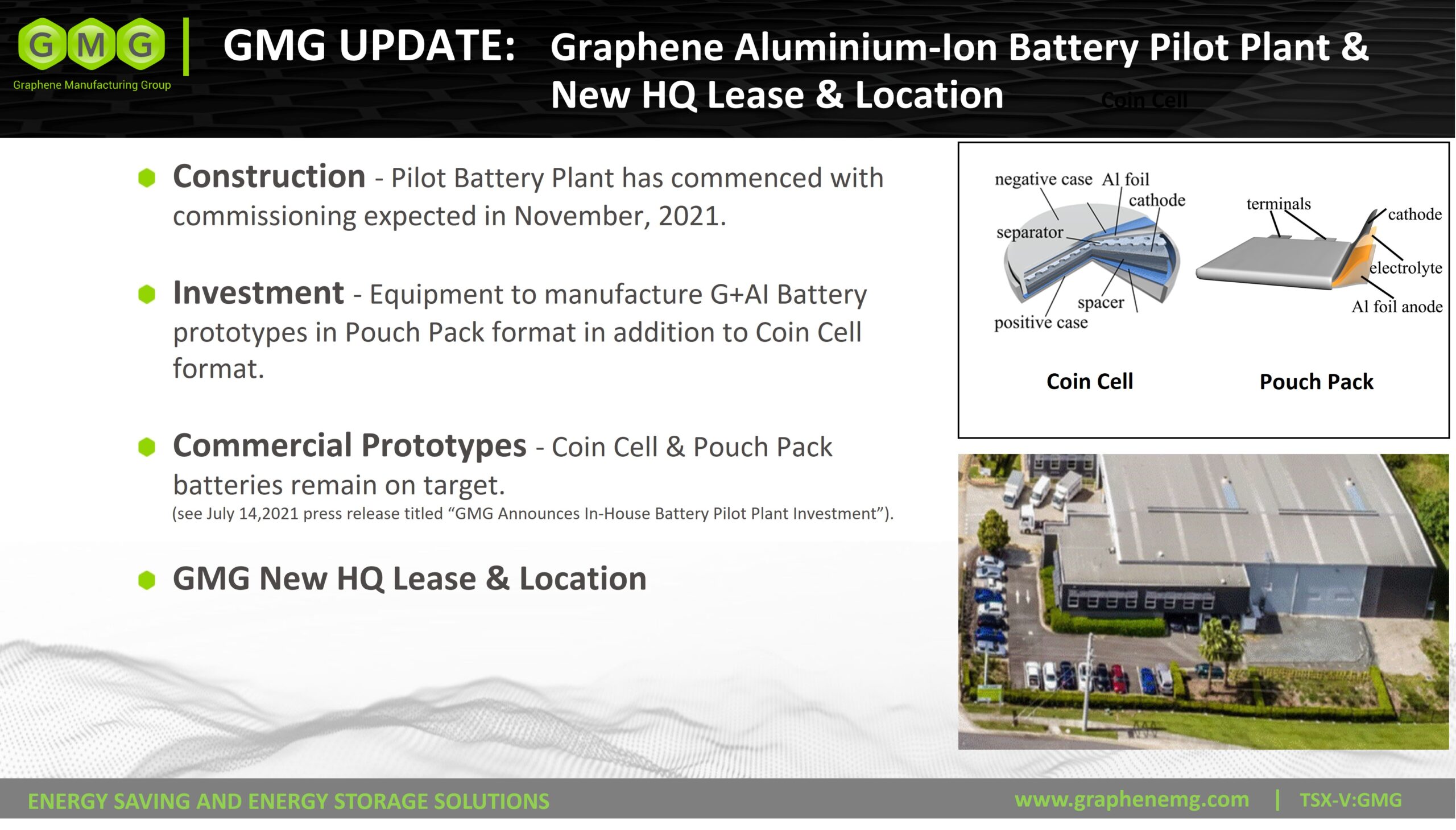

Highlights: • Construction of the Pilot Battery Plant has commenced with commissioning expected in November, 2021. • The company has purchased additional equipment to manufacture G+AI Battery prototypes in pouch pack cell format in addition to coin cell format. • Commercial prototypes for coin cell and pouch pack batteries remain on target (see July 14, […]

Oct 25, 2021 – Graphene Manufacturing Group Ltd. (TSX-V:GMG ; FRA:0GF) (“GMG” or the “Company”) is pleased to announce that GMG and Robert Bosch Australia Pty Ltd (“BOSCH”) have signed a non-binding Letter of Intent, with the aim to agree on the terms of binding agreements for BOSCH to design and deliver a Graphene Aluminium […]

BRISBANE, QUEENSLAND, AUSTRALIA – September 20, 2021 – Graphene Manufacturing Group Ltd. (“GMG” or the “Company”), at the request of the TSX Venture Exchange, is pleased to provide an update on finder’s compensation payable in connection with the Company’s non-brokered private placement of units which closed on September 2, 2021 (the “Private Placement”). The Company […]

BRISBANE, QUEENSLAND, AUSTRALIA – September 2, 2021 – Graphene Manufacturing Group Ltd. (“GMG” or the “Company”) is pleased to announce that the Company has closed its previously announced overnight marketed public offering of units (the “Units”) of the Company, including exercise in full of the over-allotment option (the “Offering”). A total of 5,635,000 Units were […]

BRISBANE, QUEENSLAND, AUSTRALIA – August 26, 2021 – Graphene Manufacturing Group Ltd. (“GMG” or the “Company”) is pleased to announce that in connection with its previously announced overnight marketed public offering (the “Offering”) of units of the Company, the Company will be conducting a concurrent private placement financing (the “Private Placement”) of units (“Units”) for […]

BRISBANE, QUEENSLAND, AUSTRALIA – August 13, 2021 – Graphene Manufacturing Group (“GMG” or the “Company”) is pleased to announce that, further to its previous news release dated August 12, 2021 announcing the overnight marketed public offering (the “Offering”) of units of the Company (the “Offered Units”), it has entered into an underwriting agreement with a […]

BRISBANE, QUEENSLAND, AUSTRALIA – August 12, 2021 – Graphene Manufacturing Group (“GMG” or the “Company”) is pleased to announce that it is undertaking an overnight marketed public offering of units (the “Offered Units”) of the Company for gross proceeds of up to CDN$10.0 million (the “Offering”). The Offering is expected to be completed pursuant to […]

July 14th, 2021 – Graphene Manufacturing Group Ltd. (TSX-V:GMG) (“GMG” or the “Company”) is pleased to announce that it is procuring equipment for a pilot production and testing plant for the manufacture of its Graphene Aluminum-Ion Batteries. Following recently published exciting performance results and very encouraging customer feedback, production of a commercial prototype coin cell […]

June 22nd, 2021 – Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the “Company”) is pleased to share further performance data of the graphene aluminium-ion coin cell batteries using the patent-pending surface perforation of graphene synthesised by the Company and the University of Queensland (“UQ”). The experiments were performed at the Australian Institute for Bioengineering […]

June 1st, 2021 – Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the “Company”) is pleased to provide the latest update on its graphene aluminium-ion battery technology (“G+AI Battery”) being developed by the Company and the University of Queensland. Since GMG’s market update on May 11, 2021 (“GMG Graphene Aluminium-Ion Battery Performance Data”), the Company […]

- 1

- 2