BRISBANE, QUEENSLAND, AUSTRALIA – Graphene Manufacturing Group Limited (TSX-V:GMG) (“GMG” or the “Company”) is pleased to announce it has engaged a capital markets advisor for the application for quotation of the Company’s securities on the OTCQX® (“OTCQX”), an over-the-counter public market in the United States. GMG’s shares will remain listed on the TSX Venture Exchange […]

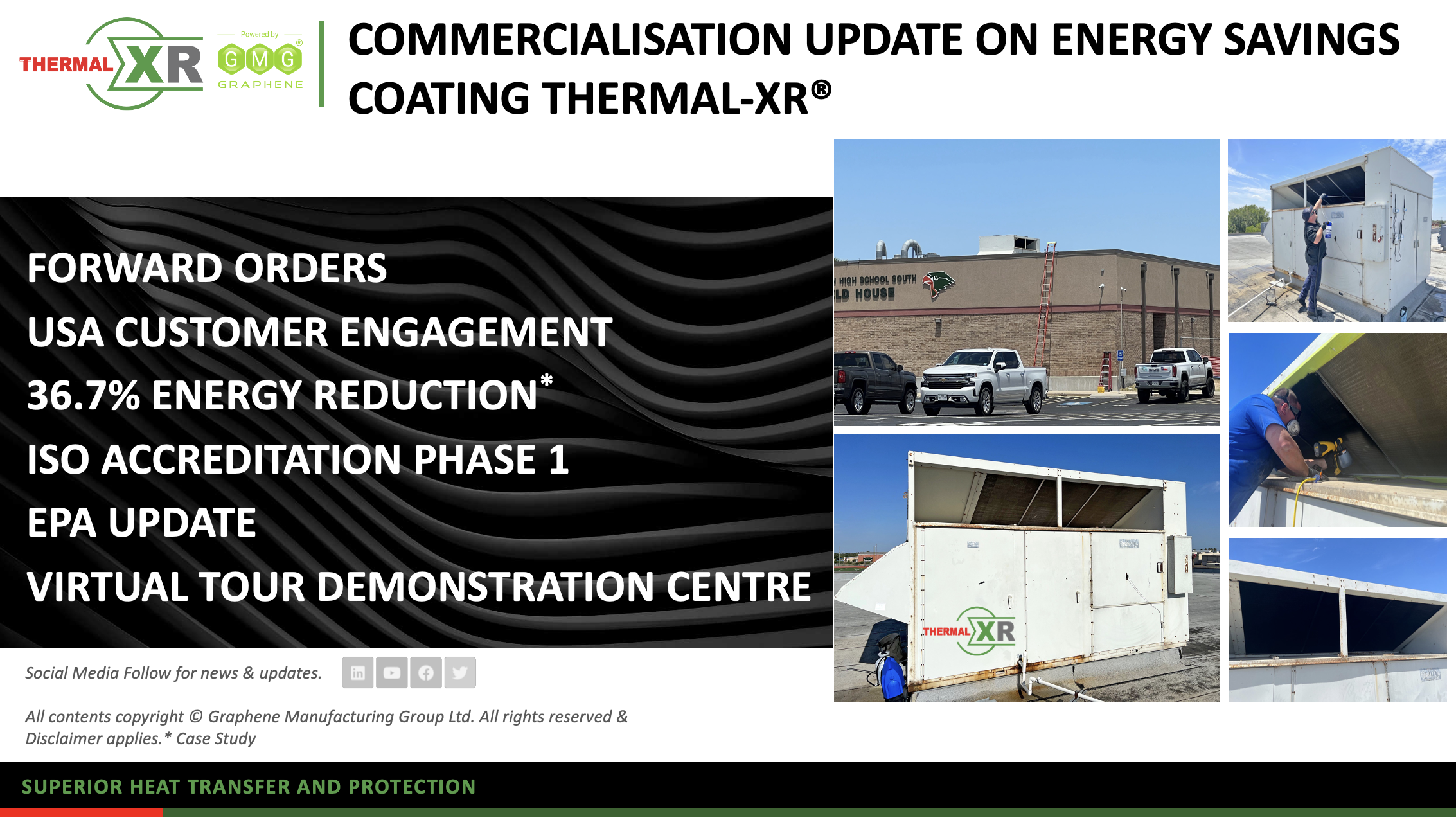

BRISBANE, QUEENSLAND, AUSTRALIA – Graphene Manufacturing Group Limited (TSX-V:GMG) (“GMG” or the “Company”) is pleased to provide a business update on the commercialisation progress of THERMAL-XR® powered by GMG Graphene. GMG has now received forward orders of over AU$400k for THERMAL-XR® from various distributors and customers worldwide. Most of the value of these orders is […]

BRISBANE, QUEENSLAND, AUSTRALIA – Graphene Manufacturing Group Ltd. (TSX-V:GMG) (“GMG” or the “Company”) is pleased to advise that Company Director Mr Jack Perkowski, based in New Jersey USA, is appointed by the Company’s board of directors as Chairman of the Board effective October 24, 2023. Upon graduation from Yale and the Harvard Business School, Mr. […]

Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the “Company”) is providing details of its upcoming Annual Meeting of shareholders (“AGM”) to be held virtually on Tuesday, November 28, 2023, at 8:00 a.m. Brisbane Australian Eastern Standard Time (being Monday, November 27, 2023 at 2:00 p.m. (Canadian Pacific Standard Time). TO VOTE AHEAD OF THE […]

BRISBANE, QUEENSLAND, AUSTRALIA – Graphene Manufacturing Group Ltd. (TSX-V:GMG) (“GMG” or the “Company”) is pleased to advise that Brandon Leong has been appointed Chief Financial Officer (CFO) effective 17th October 2023. The Company would like to thank Scott Richardson who has been Interim Chief Financial Officer (CFO) since 31 July, 2023 and has led the […]

BRISBANE, QUEENSLAND, AUSTRALIA – Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the “Company”) is pleased to advise that the Honourable Milton Dick Member for Oxley and Speaker of The Australian House of Representatives officially opened the THERMAL-XR® Coating Blending Plant on Thursday 28th September 2023. Honourable Milton Dick said “This blend plant represents a […]

GMG’s battery team attended the Australia Battery Day organized by the Advanced Materials and Battery Council (AMBC), and hosted by The University of Queensland. The event provided a platform for the battery industry to collaborate with industry, research institutions and government policy makers and discuss the requirements for the advanced materials and battery sector in […]

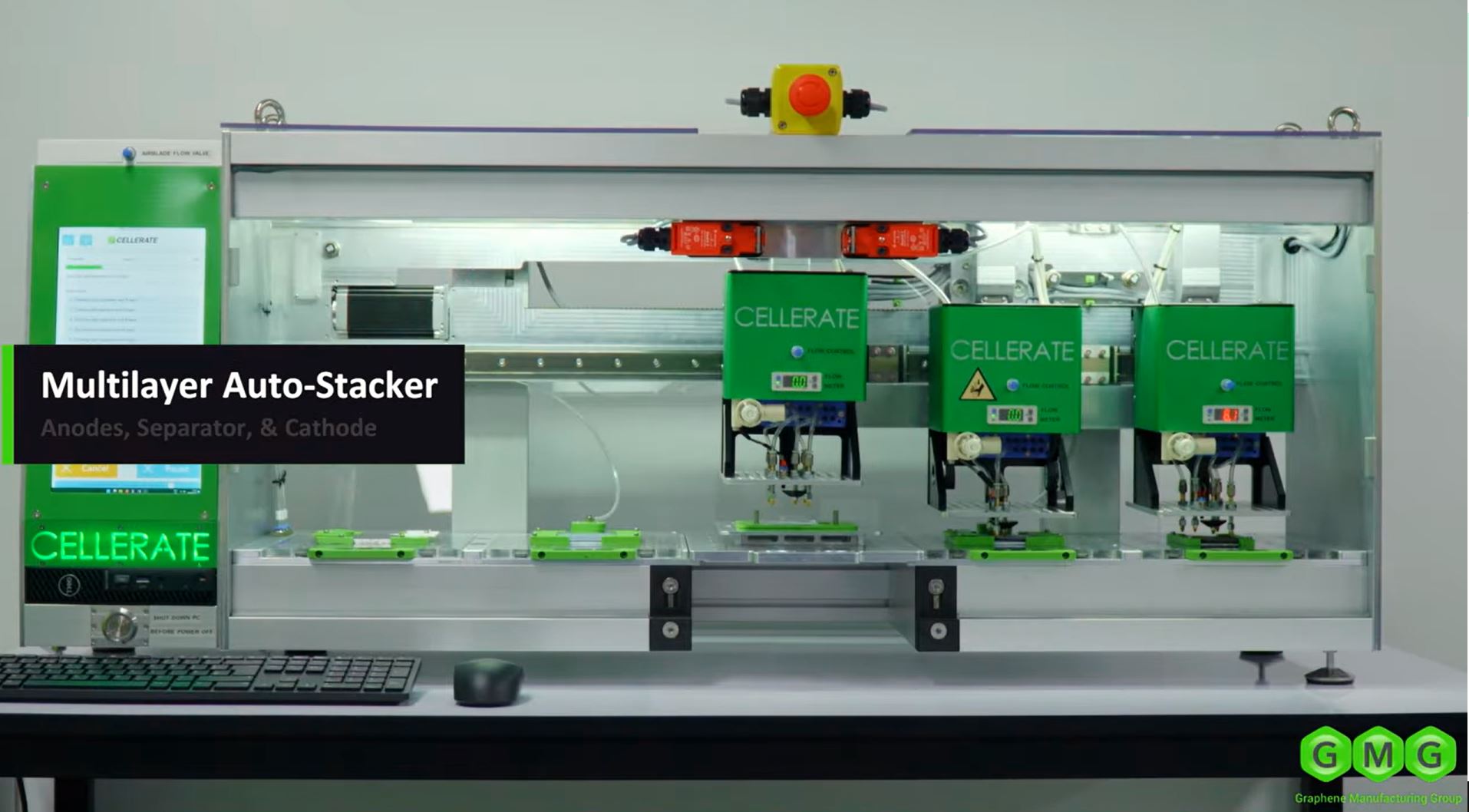

GMG is now using a new Multilayered Auto Stacker to optimise the assembly techniques of the pouch cell prototypes. ● Automates Pouch Cells Prototype Stacking ● Customises Geometrics ● Various Cell Prototype Configurations ● Increased Repeatability ● Increased Accuracy All contents copyright © Graphene Manufacturing Group Ltd. All rights reserved.

BRISBANE, QUEENSLAND, AUSTRALIA – Graphene Manufacturing Group Ltd. (TSX-V: GMG) (“GMG” or the “Company”) is pleased to provide a progress update on its Graphene Aluminium-Ion Battery technology (“G+AI Battery”) being developed by GMG and the University of Queensland (“UQ”), and on the transition from coin cells to pouch cell format. The Company has now made […]

Craig Nicol, CEO of Graphene Manufacturing Group Ltd (TSX.V:GMG), joins Radius Research to discuss GMG’s graphene manufacturing technology and graphene-based end products in the energy savings, lubricants and energy storage sectors. Please contact Graphene Manufacturing Group Ltd for more information. [email protected] www.graphenemg.com | TSX.V: GMG